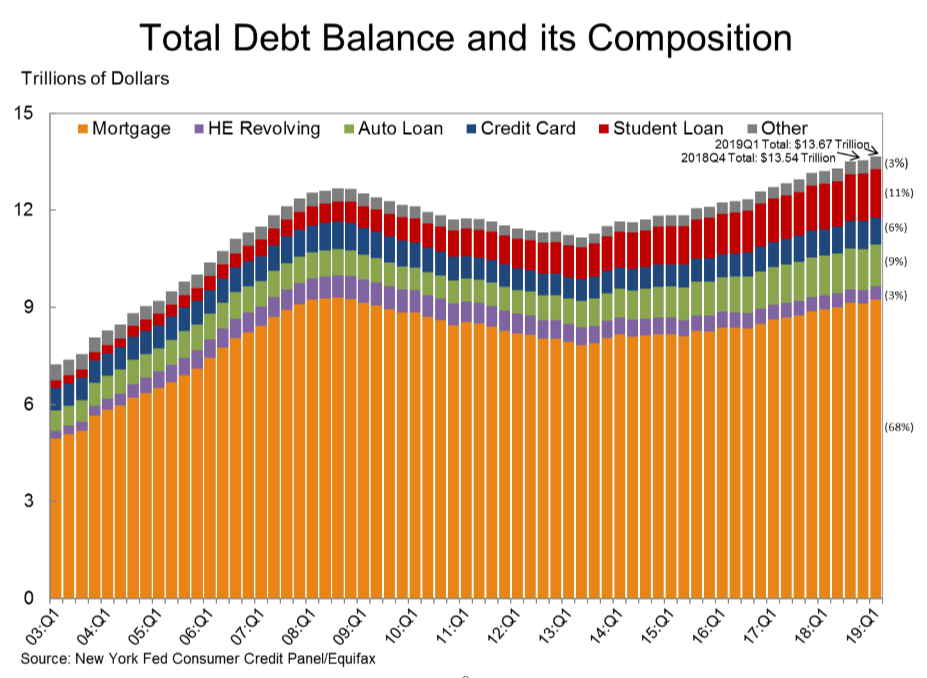

The Federal Reserve Bank of New York’s quarterly report indicates total household debt shot up almost 1 percent by $124 billions to $13.67 trillion.

Housing Debt

- Mortgage balances rose by $120 billion, to $9.2 trillion.

- Mortgage originations declined to $344 billion from $401 billion, the lowest level seen since the third quarter of 2014.

- Mortgage delinquencies improved slightly, with 1.0% of mortgage balances 90 or more days delinquent, down from 1.1% in the fourth quarter of 2018.

Non-Housing Debt

- Outstanding student loan debt increased by $29 billion, to $1.49 trillion.

- Newly originated auto loans totaled $139 billion, continuing a long-running growth trend.

- Credit card balances fell slightly, to $848 billion from $870 billion.

Bankruptcy Notations and Credit Inquiries

- About 192,000 consumers had a bankruptcy notation added to their credit reports, on par with the total from the first quarter of 2018.

- The number of credit inquiries within the past six months—an indicator of consumer credit demand—declined to around 137 million, the lowest level seen in the history of the data.

Contact a mortgage banker at Paramount today if you need help with cash-flow to complete a home improvement project or pay off debt leveraging the equity in your home.